Table of Contents

- Executive Summary: Key Findings & Market Highlights

- Market Size & 2025–2028 Growth Projections

- Latest Technology Advances in WDM Components

- Major Players & Competitive Landscape (e.g., ciena.com, corning.com, coherent.com)

- Regional Trends: Asia-Pacific, North America, and Europe Spotlight

- Key End-Use Sectors: Telecom, Data Centers, and Beyond

- Supply Chain & Manufacturing Challenges in 2025

- Emerging Trends: AI, Photonic Integration, and Sustainability Initiatives

- Regulatory Environment & Industry Standards (ieee.org, optica.org)

- Future Outlook: Disruptive Opportunities and Strategic Recommendations

- Sources & References

Executive Summary: Key Findings & Market Highlights

Wavelength Division Multiplexing (WDM) component manufacturing has entered a phase of accelerated innovation and strategic investment as of 2025, driven by global surges in data traffic, 5G deployment, and hyperscale data center expansions. Key industry players are scaling up both capacity and technological capabilities to address the exponential demand for high-bandwidth optical transmission systems.

This year, tier-one manufacturers such as Corning Incorporated, Coherent Corp. (formerly II-VI Incorporated), and Lumentum Holdings Inc. have reported significant investments in the production of optical filters, multiplexers/demultiplexers, and photonic integrated circuits (PICs). These components are at the heart of dense WDM (DWDM) and coarse WDM (CWDM) platforms, which are increasingly being adopted by telecom operators and cloud service providers worldwide.

In 2025, manufacturing trends are sharply focused on scaling output, improving component integration, and advancing the use of silicon photonics. Infinera Corporation and Ciena Corporation are expanding in-house fabrication of advanced PICs, aiming to lower costs and increase energy efficiency per transmitted bit. Meanwhile, NeoPhotonics Corporation (now part of Lumentum) continues to push the boundaries in high-speed coherent transceivers, targeting 400G and 800G applications—critical for next-generation metro and long-haul networks.

Geographically, Asia-Pacific remains a manufacturing powerhouse, with companies like Accelink Technologies Co., Ltd. and Hengtong Group scaling up both component production and R&D. These firms are leveraging government incentives and close proximity to major telecom equipment OEMs to maintain a competitive edge over North American and European counterparts.

Supply chain resilience is a dominant theme in 2025, with manufacturers increasingly localizing critical material sourcing and seeking greater control over wafer processing and assembly operations. This transition is partly in response to ongoing geopolitical uncertainties and the need for uninterrupted delivery to hyperscale and telecom clients.

Looking forward, the outlook for WDM component manufacturing is robust, with multi-year order backlogs reported by leading vendors. The ongoing shift toward 800G and emerging 1.6T solutions, as highlighted by companies like ADVA Optical Networking, is expected to further fuel demand for highly integrated, energy-efficient WDM components in both terrestrial and undersea network deployments through 2026 and beyond.

Market Size & 2025–2028 Growth Projections

The wavelength division multiplexing (WDM) component manufacturing sector is set for significant expansion between 2025 and 2028, driven by surging investments in high-speed optical networks, 5G backhaul, and hyperscale data centers. WDM components, including multiplexers, demultiplexers, optical add-drop multiplexers (OADMs), transceivers, and arrayed waveguide gratings (AWGs), are critical for maximizing fiber capacity and supporting exponential growth in global data traffic.

In 2025, the WDM component market is anticipated to experience robust demand as telecom operators and cloud service providers expand their fiber infrastructure. Leading manufacturers such as Ciena, Infinera, NeoPhotonics (now part of Lumentum), and Coherent Corp. (formerly II-VI Incorporated) continue to invest in advanced photonic integration and high-density WDM solutions to support multi-terabit transmission rates. These companies are ramping up their production capacities to meet growing orders from both network equipment vendors and direct service provider customers.

Several factors underpin the sector’s projected growth. First, the adoption of dense WDM (DWDM) and coarse WDM (CWDM) technologies is accelerating, particularly in metropolitan and regional networks, to address bandwidth bottlenecks and latency requirements. Second, advances in silicon photonics and integrated optoelectronic packaging are driving down costs and enabling mass deployment of 400G, 800G, and even emerging 1.6T transceivers, which require sophisticated WDM components for multiplexing and demultiplexing optical channels. Lumentum and Acacia Communications (a part of Cisco) are among the companies actively scaling silicon photonics-based WDM modules for these next-generation links.

Geographically, the Asia-Pacific region, led by China’s aggressive 5G and data center rollouts, is anticipated to contribute a substantial share to overall industry revenues. Major regional manufacturers such as Huawei Technologies and ZTE Corporation are investing in domestic WDM supply chains to reduce dependency on imports and support national digital infrastructure initiatives.

Looking ahead to 2028, the market outlook remains bullish, with annual growth rates expected to stay in the high single digits. This optimistic projection is underpinned by continued fiber densification, the proliferation of artificial intelligence workloads requiring ultra-fast data movement, and ongoing evolution toward all-optical networks. As a result, WDM component manufacturers are poised to benefit from sustained demand, further innovation, and global expansion through the latter half of the decade.

Latest Technology Advances in WDM Components

Wavelength Division Multiplexing (WDM) component manufacturing is experiencing rapid technological advancements as global data traffic and bandwidth demands continue to rise. In 2025, the sector is marked by significant progress in both Dense Wavelength Division Multiplexing (DWDM) and Coarse Wavelength Division Multiplexing (CWDM) technologies, driven largely by hyperscale data centers, 5G network rollouts, and next-generation fiber-optic infrastructure.

One major trend is the integration of silicon photonics into WDM components, enabling higher levels of integration, reduced power consumption, and lower manufacturing costs. Leading manufacturers such as Intel Corporation and Cisco Systems, Inc. have accelerated the commercialization of silicon photonic transceivers, multiplexers, and demultiplexers. Their efforts are focused on scaling transceiver data rates to 400G and 800G, with early prototypes for 1.6T applications beginning to emerge.

Another key advance is the improvement in thin-film filter technology and arrayed waveguide grating (AWG) manufacturing. Companies like NeoPhotonics Corporation and Lumentum Holdings Inc. are leveraging precision nano-fabrication and automated assembly techniques to achieve tighter channel spacing, higher channel counts, and improved insertion loss characteristics. These improvements are critical for supporting high-capacity DWDM systems in metropolitan and long-haul networks.

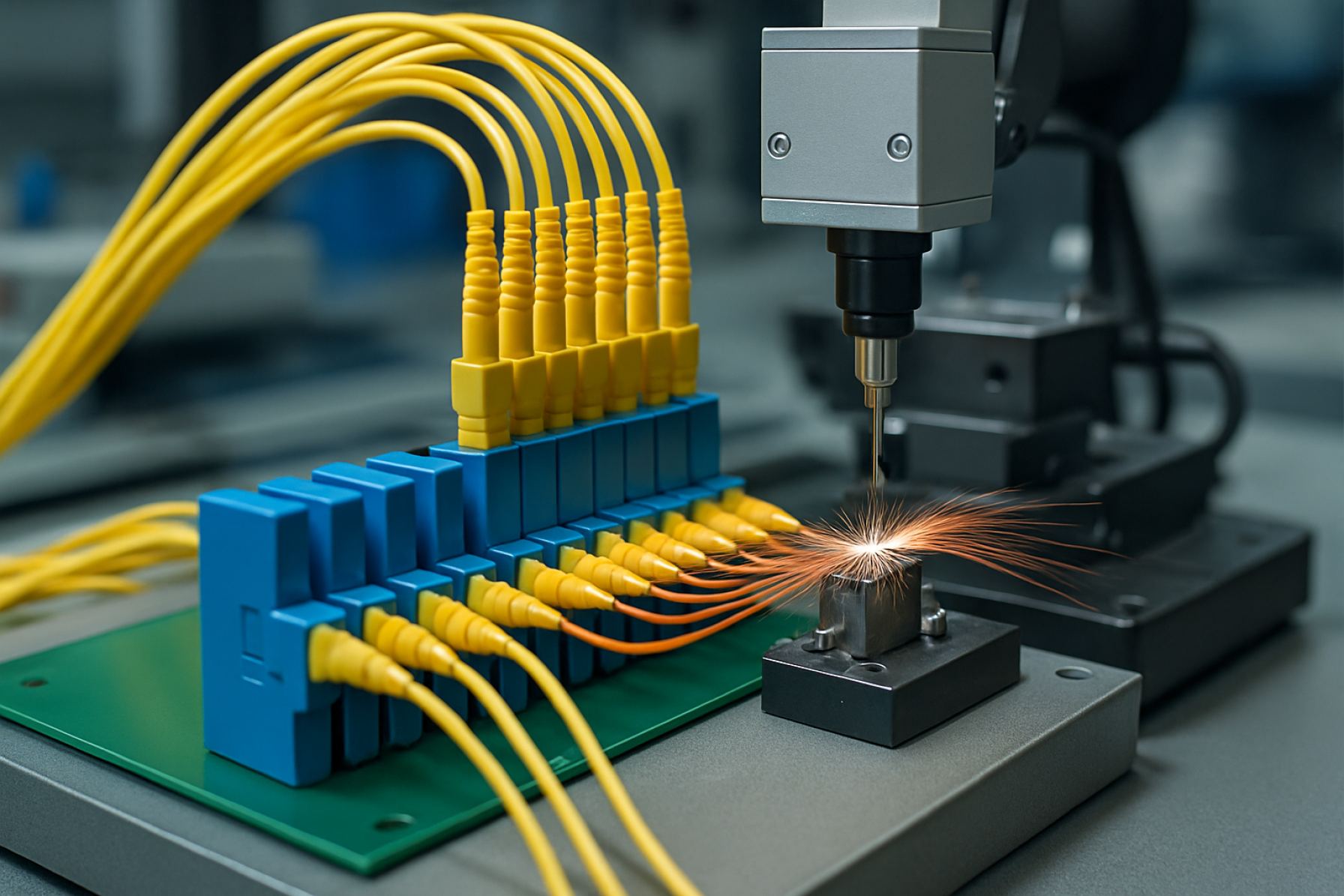

Manufacturing automation and process control have also advanced, with increased adoption of robotics and AI-driven quality assurance. Corning Incorporated and Coherent Corp. (formerly II-VI Incorporated) are investing in smart manufacturing lines that utilize machine vision and predictive analytics to minimize defects and boost production yields. This is particularly important as the industry faces growing demand for customized and high-volume WDM components.

Looking ahead to the next few years, the outlook for WDM component manufacturing remains robust. Demand growth is anticipated from the expansion of cloud computing, AI workloads, and the ongoing rollout of 400G/800G data center connectivity. Novel materials, such as lithium niobate and advanced polymers, are being explored to further enhance performance and scalability. Moreover, industry collaborations and standardization efforts—spearheaded by organizations like the Optical Internetworking Forum (OIF)—are expected to accelerate the adoption of interoperable and cost-effective WDM solutions.

In summary, the WDM component manufacturing sector in 2025 is defined by innovation in silicon photonics, advanced filtering technologies, intelligent automation, and ongoing efforts to support ever-increasing data transmission needs. With leading companies pioneering new materials and processes, the industry is well-positioned to meet the next generation of bandwidth and efficiency challenges.

Major Players & Competitive Landscape (e.g., ciena.com, corning.com, coherent.com)

The competitive landscape of wavelength division multiplexing (WDM) component manufacturing in 2025 is shaped by a mix of established global corporations and agile niche players, all responding to surging demand for higher bandwidth, 5G rollout, and hyperscale data centers. Key industry leaders include Ciena Corporation, Corning Incorporated, and Coherent Corp., each with significant investments in both core research and large-scale production of optical components.

Ciena Corporation continues to expand its portfolio of WDM solutions, focusing on advanced transceivers and programmable photonic line systems. The company’s WaveLogic technology has seen recent iterations aimed at supporting 800G and 1.6T transmission rates, reflecting ongoing innovation to serve cloud and telecom operators’ scaling needs. Ciena’s partnerships with hyperscalers and telecom carriers globally further consolidate its position as a dominant force in WDM component manufacturing.

Corning Incorporated remains a foundational supplier of optical fiber and WDM-compatible cable assemblies. Corning’s recent expansions in manufacturing capacity—particularly in North America and Asia—are designed to address anticipated spikes in demand from 5G backhaul and FTTH projects. The company’s innovations in low-loss, high-density fiber technologies directly support next-generation WDM networks by enabling longer reach and greater channel counts.

Coherent Corp., formed through the merger of II-VI and Coherent, leverages vertical integration across lasers, optical amplifiers, multiplexers, and on-chip photonics. The company’s 2025 roadmap emphasizes miniaturization and integration, with a sharp focus on silicon photonics and advanced modulators that enable compact, power-efficient WDM components suited for data center interconnects and edge computing.

Other notable players shaping the WDM components arena include II-VI Incorporated (now part of Coherent), Lumentum Holdings (with its strong transceiver and ROADM portfolio), and Fujikura Ltd. (a prominent supplier of fiber and WDM modules). Regional manufacturers in China, such as Hengtong Group, are scaling rapidly, leveraging domestic market demand and government support for digital infrastructure.

Looking ahead, the competitive landscape is expected to intensify as manufacturers race to commercialize next-generation WDM components supporting 1.6T and beyond, with integration, energy efficiency, and cost reduction as primary battlefields. Strategic collaborations between component vendors, system integrators, and network operators will likely accelerate, while ongoing supply chain investments aim to mitigate recent material shortages and geopolitical risks.

Regional Trends: Asia-Pacific, North America, and Europe Spotlight

Wavelength Division Multiplexing (WDM) component manufacturing is experiencing significant regional shifts and advancements, with Asia-Pacific, North America, and Europe each playing pivotal roles in the evolution of the sector through 2025 and beyond.

In the Asia-Pacific region, robust investments in 5G infrastructure and data center expansion are accelerating demand for WDM components. Major manufacturers such as NEC Corporation and Fujitsu are expanding their production capabilities to support next-generation optical networks. China, in particular, continues to be a global manufacturing hub, with companies like Huawei Technologies and ZTE Corporation heavily involved in the mass production of optical transceivers, multiplexers, and related WDM components. The region benefits from strong government backing and a vast electronics supply chain, positioning Asia-Pacific as the fastest-growing market segment for WDM components through the mid-2020s.

North America remains at the forefront of WDM innovation, driven by ongoing investments in hyperscale data centers and fiber-optic network upgrades. Companies such as Ciena and Infinera are leading the charge in developing advanced WDM systems and integrated photonic devices. The United States, in particular, is witnessing increased collaboration between network operators and manufacturers to accelerate the deployment of high-capacity optical transport solutions. Furthermore, North American manufacturers are investing in automation and photonic integration to scale up production while maintaining stringent quality standards, targeting both domestic and export markets.

Europe, meanwhile, is leveraging its expertise in precision optical engineering and a strong focus on sustainability. Companies like Nokia and ADVA Optical Networking are at the forefront in developing energy-efficient WDM solutions tailored for metro and long-haul applications. The European Union’s digital agenda and funding initiatives are further catalyzing the modernization of optical networks, stimulating demand for locally manufactured WDM components. European manufacturers are also prioritizing the circular economy and eco-design principles in component production, enhancing their competitive edge in global markets.

Looking ahead, regional trends in WDM component manufacturing will continue to be shaped by infrastructure rollouts, technological innovation, and policy incentives. While Asia-Pacific is set to maintain its lead in volume production, North America’s and Europe’s strengths in R&D and quality are expected to drive advancements in next-generation WDM technologies, such as coherent optics and integrated photonics, through 2025 and beyond.

Key End-Use Sectors: Telecom, Data Centers, and Beyond

Wavelength Division Multiplexing (WDM) component manufacturing is poised for significant expansion in 2025 and the following years, driven by the escalating demand from key end-use sectors—telecommunications, data centers, and emerging segments such as high-performance computing and metropolitan networks. The telecommunications industry remains the largest consumer, as global carriers continue to upgrade optical networks to support 5G rollouts, edge computing, and the explosive growth of high-speed broadband. Leading manufacturers such as Ciena and Infinera are investing in advanced WDM components like high-density multiplexers, reconfigurable optical add-drop multiplexers (ROADMs), and tunable transceivers to meet these evolving network architectures.

In parallel, the data center sector is rapidly emerging as a critical market for WDM components. Hyperscale operators and colocation providers are scaling up their adoption of coherent optics and DWDM technology to increase interconnect bandwidth and optimize data traffic within and between facilities. Companies such as Lumentum and NeoPhotonics (acquired by Lumentum) are supplying next-generation tunable lasers, multiplexers, and amplified modules tailored for the unique requirements of data center interconnects—where low latency and high port density are paramount.

Beyond telecom and data centers, WDM component manufacturing is expanding into new use cases, including 5G fronthaul/backhaul, smart city infrastructure, and industrial IoT. The versatility of WDM—allowing multiple wavelengths to be transmitted over a single fiber—positions it as a foundational technology for bandwidth-intensive applications such as autonomous vehicles and remote healthcare systems.

On the manufacturing front, the sector is witnessing a trend toward integration and miniaturization. Players like Acacia Communications (now part of Cisco) are pioneering silicon photonics-based WDM components, which promise lower costs and power consumption. Additionally, Coherent Corp. (formerly II-VI Incorporated) is ramping up production of indium phosphide and silicon photonics chips, anticipating strong demand from both legacy telecom operators and cloud providers.

Looking ahead, the outlook for WDM component manufacturing is robust, with supply chain investments and strategic partnerships expected to accelerate innovation. With 800G and 1.6T optical modules entering the market, component makers are set to play a pivotal role in the next wave of network infrastructure upgrades across all key end-use sectors.

Supply Chain & Manufacturing Challenges in 2025

The supply chain and manufacturing landscape for Wavelength Division Multiplexing (WDM) components is experiencing notable turbulence as 2025 unfolds. WDM technology, crucial for expanding optical network capacity, relies on a sophisticated value chain encompassing specialty glass, precision optics, semiconductor lasers, filters, and integrated photonic components. The global expansion of data centers and 5G networks continues to drive surging demand for WDM modules, but manufacturers face substantial challenges in balancing output with quality and timely delivery.

One of the major bottlenecks is persistent tightness in the supply of key raw materials, including high-purity optical glass, indium phosphide, and silicon wafers. Major WDM component manufacturers such as Lumentum and Coherent have reported that disruptions in material procurement—exacerbated by geopolitical factors and export controls—continue to extend lead times for critical subcomponents. Additionally, the complexity of WDM device assembly, which often requires ultra-clean environments and sub-micron precision, further constrains capacity ramp-up.

Another challenge is the ongoing shortage of specialized manufacturing equipment. Suppliers of photonic packaging tools and automated wafer processing systems, such as AMETEK and Applied Materials, are facing high order backlogs. Equipment lead times, which ballooned during the pandemic, remain extended, impeding the ability of WDM component makers to expand or modernize production lines in the short term.

Supply chain resilience is also under scrutiny. The majority of WDM component manufacturing remains concentrated in East Asia, particularly China and Taiwan, creating vulnerabilities to regional disruptions. In response, leading firms like NeoPhotonics and OptoCom are exploring diversification strategies, including partnerships and secondary sourcing in North America and Europe.

On the outlook for 2025 and beyond, the industry is expected to gradually mitigate some supply bottlenecks via increased automation and investment in localized production. However, the need for skilled labor in photonics packaging and the ongoing global competition for semiconductor talent will remain persistent hurdles. In sum, while WDM component demand is robust, supply chain and manufacturing constraints in 2025 are shaping a cautious outlook, with companies focusing on supply diversification, operational efficiency, and risk mitigation to ensure sustained innovation and delivery in the years ahead.

Emerging Trends: AI, Photonic Integration, and Sustainability Initiatives

The manufacturing landscape for Wavelength Division Multiplexing (WDM) components is undergoing significant transformation in 2025, driven by AI-enabled design automation, photonic integration advances, and heightened sustainability initiatives.

A key trend is the integration of artificial intelligence (AI) and machine learning into both the design and production phases of WDM components. Leading manufacturers are adopting AI-driven simulation and process control to optimize device performance, predict yield outcomes, and accelerate the development of next-generation multiplexers, demultiplexers, and optical filters. This approach is exemplified by companies such as Infinera Corporation and Coriant, which have publicly discussed leveraging data-driven automation to enhance manufacturing precision and scale up the production of complex photonic integrated circuits (PICs) for dense WDM systems.

Photonic integration remains at the forefront of WDM component innovation, with the industry shifting from discrete component assemblies towards highly integrated PIC platforms. Silicon photonics technology is gaining momentum, enabling the integration of multiple WDM functions—such as multiplexing, switching, and amplification—on a single chip. This trend is reducing both footprint and power consumption, while supporting the escalating bandwidth demands of data centers and metropolitan networks. Companies like Coherent Corp. and NeoPhotonics are investing heavily in silicon photonics foundries and automated assembly lines, aiming to deliver compact, scalable, and cost-efficient WDM transceivers and modules for 400G/800G and beyond.

Sustainability is another major driver shaping manufacturing strategies in 2025. WDM component manufacturers are prioritizing the use of eco-friendly materials, energy-efficient fabrication processes, and circular economy principles. Efforts to minimize rare earth and conflict mineral usage, reduce hazardous waste, and implement closed-loop recycling for wafer materials are being reported by industry leaders. Lumentum Holdings and VIAVI Solutions have set public sustainability goals, including reductions in greenhouse gas emissions and commitments to greener supply chains, aligning with the broader industry’s shift toward responsible manufacturing.

Looking ahead, the convergence of AI-driven manufacturing, photonic integration, and sustainability initiatives is expected to define the competitive landscape for WDM component suppliers. These trends will support the ongoing scaling of optical networks while addressing environmental and economic imperatives, positioning the sector for robust growth and innovation through the next several years.

Regulatory Environment & Industry Standards (ieee.org, optica.org)

The regulatory environment and industry standards are foundational to the manufacturing and deployment of Wavelength Division Multiplexing (WDM) components. As the global demand for higher bandwidth and network flexibility surges into 2025 and the coming years, regulatory oversight and standardization efforts have intensified to ensure interoperability, safety, and innovation within the sector.

The Institute of Electrical and Electronics Engineers (IEEE) continues to play a leading role in shaping industry standards relevant to WDM, particularly through its IEEE 802.3 family addressing physical layer specifications for Ethernet, including standards for 400G/800G optical transceivers leveraging dense WDM technologies. Recent amendments focus on spectral allocation, channel spacing, and interoperability, facilitating integration across diverse vendor equipment and supporting emerging applications such as data center interconnects and long-haul communications.

In parallel, Optica (formerly OSA) serves as a central platform for consensus-building and dissemination of best practices in optical component manufacturing. Optica’s technical groups and conferences in 2025 emphasize the necessity for tighter control of insertion loss, crosstalk, and spectral performance of multiplexers/demultiplexers, as well as standards for testing and traceability. Their collaboration with industry partners further accelerates the adoption of advanced manufacturing methods, such as silicon photonics integration, which require updated protocols for quality assurance and environmental compliance.

Globally, regulatory bodies are also responding to advances in WDM technology. Requirements for RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) compliance remain critical in component manufacturing, particularly as manufacturers in Asia, Europe, and North America seek to harmonize production with international environmental directives. Additionally, spectrum management authorities are engaging in ongoing reviews to optimize allocation in response to the proliferation of new wavelengths and channel counts, particularly in the C-band and L-band, which are central to modern WDM systems.

Looking ahead, the outlook for WDM component manufacturing is shaped by the convergence of these regulatory and standardization efforts. With the continued push for higher data rates (1.6T and beyond) and sustainability in photonic production, manufacturers are expected to invest heavily in compliance infrastructures and in aligning with evolving industry standards. This environment is set to foster increased collaboration between standards bodies like IEEE and Optica, and the manufacturing community, ensuring that WDM components meet the stringent demands of next-generation optical networks.

Future Outlook: Disruptive Opportunities and Strategic Recommendations

The outlook for wavelength division multiplexing (WDM) component manufacturing in 2025 and the coming years is characterized by accelerating innovation, robust demand drivers, and a landscape ripe for both disruption and strategic investment. As global data consumption surges and telecommunications operators continue aggressive fiber deployments to support 5G, cloud computing, and AI-driven applications, WDM technology—enabling multiple optical signals to share a single fiber—remains central to network scalability and efficiency.

Among the most disruptive opportunities is the ongoing shift from traditional discrete optics to highly integrated photonic components. This integration, driven by advances in silicon photonics, promises lower costs, reduced power consumption, and higher component density. Major manufacturers such as Ciena and Infinera are already producing advanced WDM modules that leverage these technologies, with plans to increase production scale and performance in the near term. Startups and established players alike are investing heavily in PIC (photonic integrated circuit) manufacturing, aiming to address both long-haul and metro network expansion.

Another trend is the growing demand for coherent WDM transceivers capable of supporting 400G, 800G, and beyond—driven by hyperscale data centers and international backbone upgrades. Companies such as Lumentum and NeoPhotonics (now part of Lumentum) are expanding their portfolios with coherent optical modules and components, targeting both legacy and greenfield network builds. These manufacturers are also focusing on automation and yield optimization to meet the rigorous quality and volume expectations of Tier 1 telecom operators.

Strategically, supply chain resilience and regional diversification are emerging as priorities. The geopolitical climate, particularly US-China technology tensions, is prompting North American and European manufacturers to localize production and secure alternative sources for critical materials and subcomponents. For instance, Coherent Corp. (formerly II-VI Incorporated) has announced investments in expanding manufacturing capabilities in both the USA and Europe to address these concerns.

Looking ahead, the WDM component sector may see further disruption from quantum photonics and new materials such as lithium niobate on insulator (LNOI), which promise even higher bandwidth and lower latency. Strategic recommendations for stakeholders include prioritizing R&D in integrated photonics, strengthening supply chain partnerships, and staying agile to adopt next-generation modulation and packaging techniques. Collaborations with leading network operators and cloud service providers will be critical to aligning product development with market needs and capturing emerging opportunities in the evolving optical networking landscape.

Sources & References

- Lumentum Holdings Inc.

- Infinera Corporation

- Ciena Corporation

- NeoPhotonics Corporation

- Hengtong Group

- ADVA Optical Networking

- Acacia Communications

- Huawei Technologies

- ZTE Corporation

- Cisco Systems, Inc.

- Coherent Corp.

- NEC Corporation

- Fujitsu

- Nokia

- AMETEK

- Coriant

- VIAVI Solutions

- IEEE

- Optica